Par Alexandre Laizet,

Data Analytics & Artificial Intelligence Senior Consultant, EY

In the midst of the Russia-Ukraine conflict, the European Union (“EU”) has seemed to have no choice but to burn more coal – the most carbon intensive type of energy – to limit its dependency to Russian gas and oil[1].

This is a challenge for the European Green Deal, which aim is to “transform the EU into a modern, resource-efficient and competitive economy, ensuring no net emissions of greenhouse gases by 2050, economic growth decoupled from resource use, and no person and no place left behind”[2].

Bitcoin – a peer-to-peer electronic cash system[3], is also considered by many in 2022 as a challenging net negative for the environment[4], and a ban of Bitcoin mining operations has been considered in the EU[5] to reach the 1.5C Paris climate goal[6].

Bitcoin uses the energy-consuming decentralized computational power of Proof-of-Work innovation – “a nuclear-resistant digital defense infrastructure”[7] – to project power in order to reclaim a digital permissionless control structure over money and digital property, as described by Jason Lowery[8].

However, everything is energy-consuming and the common assumption that Bitcoin is bad for the environment does not account for the core value proposition of Bitcoin[9] nor for the fact that Bitcoin uses 56 times less energy than traditional electronic payments and is more efficient even at a single transaction level[10].

The failed attempts to ban Proof-of-Work protocols such as Bitcoin[11], or to disincentivize mining operations through unclear-threatening regulations[12], might therefore not be justified.

Given the relatively small EU bitcoin mining share as of January 2022[13] – less than 10%, in comparison with the United States – more than 70%, this technological innovation gap may even become a sovereignty issue[14] between regions gaining access to new sources of economic development and capital preservation powered by sustainable energy through Bitcoin[15], and regions/countries attempting to remove themselves from the benefits of this permissionless and censure-resistant network of privately funded green growth[16] – such as Europe and China.

Not only Bitcoin arguably consumes less energy than the traditional financial system, and is scalable through Layer 2 solutions built on top of it such as the Lightning Network[17], but its miners could be instrumental in delivering on the ideal of a strong economy built on top of sustainable foundations – but that would need to overcome certain challenges, which raises the question of how the Green Deal could be powered by Bitcoin.

1. Bitcoin is an industry leader in sustainability

One of the key benefits expected from the European Green Deal is to provide future generations with cleaner energy and cutting-edge technological innovation[18].

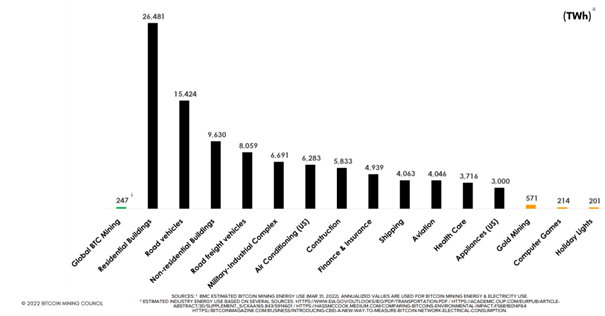

Bitcoin (“BTC”) can be considered as one of the greatest inventions of our times[19] and it already has a 58% sustainable energy mix[20]. The amount of global energy used by bitcoin mining – 0.16%, and the consumption of total global carbon emissions – 0.085%, can be considered inconsequential/negligeable, compared to other industries – see below[21]:

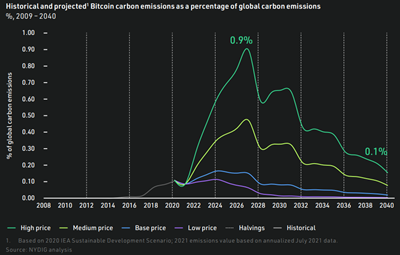

Even in a high price scenario (i.e., USD 490,000 per bitcoin by 2030 – equaling the USD 10 trillion historical average market value of gold, and USD 595,000 per bitcoin by 2040 with the assumption of a slower rise over time), it is estimated that Bitcoin’s carbon emissions might raise up to a peak of 0.9% of global carbon emissions, that would then steadily decrease towards 0.1% in 2040 – see below[22]:

2. Bitcoin mining is on its way towards net zero carbon emissions

The Bitcoin clean energy initiative[23] has made several propositions to accelerate the global energy transition. One of them is to help wind and solar energy providers to provide a more stable supply through the monetization of otherwise wasted surplus energy that would power bitcoin mining the majority of time, but be quickly redirected to populations in case of pic demand. Other solutions for Bitcoin miners to foster clean energy use and reach net zero carbon emissions include the following[24]:

- Purchasing carbon offsets to neutralize emissions, such as tree planting or carbon sequestration

- Procuring renewable energy through the purchase of renewable energy certificates, or contracting “green tariff” programs with local electricity suppliers, or entering in power purchase agreements with renewable energy generators

- Favoring locations with renewable energy, and using otherwise wasted energy (e.g., curtailed hydro power, flared gas)

Given the growing importance of Environmental, Social, and Governance (“ESG”) principles for investors[25], and the carbon intensive energy price soaring[26], Bitcoin miners are accelerating their inclination towards net zero carbon emissions[27].

3. Bitcoin mining is funding the development of clean energies

Blockstream, Square and Tesla recently announced a partnership to build a solar-powered Bitcoin mining facility in Texas[28]. In France, leading bitcoin miners like Bigblock[29] specialize in helping countries or companies monetize new hydroelectric power facilities with bitcoin mining activities[30].

This opportunity is starting to be recognized by governments around the world as key to stabilize and decarbonize the power grid, such as in Texas[31]. In France, the French Member of Parliament Pierre Person[32] also proposed to increase the financing of new sources of renewable energy by fostering partnerships between energy producers and miners of crypto assets such as Bitcoin, in order to use the surplus of energy that would otherwise be lost[33].

4. Bitcoin is incentivizing people to think of their future

As brilliantly explained by Saifedean Ammous in his renowned books – The Bitcoin Standard and The Fiat Standard, Bitcoin’s decentralized monetary system is based on a censorship-resistant cryptographically-enabled scarcity that allows bitcoin holders to reduce their time preference (e.g., focus on long term sustainable investment over short term excessive consumption) by being able to efficiently transfer value across time and space[34] – as opposed to the politically-programmed loosing value of fiat currencies[35] that incentivize instant gratification at the expense of savings.

By pricing and/or paying products and services with Bitcoin[36], it is likely that people would spend more time analyzing whether what they purchase will be valuable for them, their family, the society and the environment in the future before spending their incorruptible satoshis (units of a bitcoin). This is an ongoing change in human behavior that is caused by cutting-edge sound money technology[37], and it could be argued that it has the potential to contribute greatly to the goals of the EU Green Deal, without needing public funding.

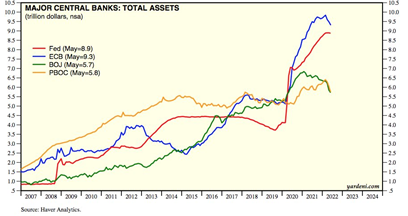

This opportunity for a more sustainable world with Bitcoin might give birth to some challenges, though. First, a hyperinflation scenario under the current fiat system[38] might lead to mass adoption of a Bitcoin standard that could create a de facto separation between State and Money, which might tempt governments to protect the traditional monetary system through restrictive measures against bitcoin usage, which in turn could lead to a separation between producers and consumers[39]. Second, the existing regulatory framework might not be adapted to the specificities of Bitcoin, or the willingness of regulators to protect consumers might be in conflict with basic financial/privacy freedom/rights, and could stifle innovation and sustainable economic development[40]. Third, civil unrest caused in the future by growing inequalities between those that were able to acquire, self-custody and hold bitcoin early enough, and those that were not cannot be ruled away given Bitcoin’s fixed supply, especially when populations have been used for the last decades – and increasingly since the Covid-19 pandemic, to fiat money creation out of thin air, as summarized by the chart below[41]:

[1] Financial Times, “EU accepts it will burn more coal in move away from Russian gas” ;

EU warns against fossil fuel ‘backsliding’ as coal replaces Russian gas

[2] https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en

[3] Link to the Bitcoin Whitepaper published by Satoshi Nakamoto

[4] https://www.greenpeace.org/usa/news/change-the-code-not-the-climate-greenpeace-usa-ewg-others-launch-campaign-to-push-bitcoin-to-reduce-climate-pollution/

[5] https://bitcoinmagazine.com/markets/eu-parliament-backtracks-ban-on-bitcoin-proof-of-work

[6] https://www.euronews.com/next/2021/11/12/europe-must-ban-bitcoin-mining-to-hit-the-1-5c-paris-climate-goal-say-swedish-regulators

[7] https://bitcoinmagazine.com/culture/can-bitcoin-miners-replace-global-consensus#:~:text=As%20Lowery%20puts%20it%2C%20Bitcoin,over%20money%20and%20digital%20property.

[8] Jason Lowery is a commissioned officer in the U.S. Space Force and a U.S. National Defense Fellow enrolled in MIT, whose full-time job is to research Bitcoin for the U.S. Department of Defense (DoD)

[9] https://www.lynalden.com/bitcoin-energy/

[10] https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4125499

[11] https://www.euronews.com/next/2021/09/27/china-s-ban-on-crypto-trading-and-mining-will-ultimately-fail-here-s-why

[12] https://www.ledger.com/blog-why-the-eus-transfer-of-funds-tfr-regulation-is-a-threat-to-financial-freedom

[13] https://ccaf.io/cbeci/mining_map

[14] https://adan.eu/wp-content/uploads/2022-02-08-Adan-EU-POW-Ban-Position-1.pdf

[15] https://www.forbes.com/sites/jasonbrett/2021/10/02/texas-poised-to-be-a-world-leader-in-bitcoin-and-blockchain/?sh=2ea78f0d715b

[16] https://www.coindesk.com/business/2022/05/17/bitcoin-mining-appears-to-have-survived-ban-in-china/

[17] https://github.com/lnbook/lnbook

[18] https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en

[19] https://breedlove22.medium.com/the-number-zero-and-bitcoin-4c193336db5b

[20] https://bitcoinminingcouncil.com/wp-content/uploads/2022/04/2022.04.25-Q1_2022_BMC_Presentation.pdf

[21] https://bitcoinminingcouncil.com/wp-content/uploads/2022/04/2022.04.25-Q1_2022_BMC_Presentation.pdf

[22] https://assets-global.website-files.com/614e11536f66309636c98688/616dbaa0e7aa2af652d58983_NYDIG-BitcoinNetZero_SML.pdf

[24] https://assets-global.website-files.com/614e11536f66309636c98688/616dbaa0e7aa2af652d58983_NYDIG-BitcoinNetZero_SML.pdf

[25] https://blockworks.co/valkyrie-rolls-out-new-bitcoin-mining-etf-on-nasdaq/

[26] https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220317_2~dbb3582f0a.en.html

[27] https://bitcoinist.com/bitcoin-miners-cutting-costs-by-going-green/

[28] https://bitcoinmagazine.com/business/blockstream-square-solar-powered-mining ; https://blog.blockstream.com/blockstream-and-block-inc-s-solar-mining-facility-now-powered-by-tesla-solar-pv-and-megapack/

[29] https://bdatacenter.fr/en/about-us/

[30] https://www.lemonde.fr/afrique/article/2022/05/27/centrafrique-bangui-improbable-capitale-du-bitcoin_6127935_3212.html

[31] https://www.austinforum.org/june-14-2022.html ;

[32] https://medium.com/@pierreperson/monnaies-banques-et-finance-vers-une-nouvelle-e%CC%80re-crypto-f462235347ba

[33] https://www.thenationalnews.com/business/cryptocurrencies/2022/05/18/bitcoin-will-fund-clean-energy-revolution-say-defiant-industry-chiefs/#:~:text=In%20research%20released%20last%20year,annual%20energy%20usage%20of%20Sweden ; https://www.lynalden.com/bitcoin-energy/#wasted

[34] Bitcoin can be considered as digital energy – a concept further developed from an engineering point of view by Michael Saylor, that helps its holders develop a mental capacity to focus on longer time horizons tasks and types of consumption.

[35] https://www.ecb.europa.eu/ecb/tasks/monpol/html/index.en.html#:~:text=We%20are%20targeting%20an%20inflation,inflation%20that%20is%20too%20high.

[36] El Salvador has recently become the first nation state to adopt Bitcoin as legal tender, confirming the potential for the type of Bitcoin adoption where goods and service start to be priced in bitcoin – although many companies worldwide were already using bitcoin as a medium of exchange without the need for a legal tender

[37] Saifedean Ammous, “How Bitcoin changes human behaviour”, Property and Freedom Society Lecture

[38] https://www.whatbitcoindid.com/podcast/is-hyperinflation-coming-preston-pysh

[39] The Investor’s Podcast Network, Jack Dorsey’s Decentralized Identity Network w/ Pablo Fernandez (BTC083)

[40] https://www.ledger.com/blog-how-can-the-eu-win-web3-ledgers-4-recommendations-for-eu-policy-makers